Economics and fees

Producer responsibility has certain implications, both in the form of costs and revenues. Statutory costs consist of a one-off registration fee and an annual quantity-based fee to DPA. Portable batteries entail an additional payment to SKAT (Danish Tax). New minimum requirements entail that collective schemes must use modulated fees from year 2024.

Portable batteries and payment to SKAT

*)If you import portable batteries you must pay for municipal collection through SKAT (Danish Tax and Customs Administration).

SUP products: Report and payment to Danish EPA

If you produce or import filters for use in tobacco products, You are required to register for producer responsibility here at DPA, but you must pay and report to the Danish EPA (Environmental Protection Agency).

Economy

Fee rates and invoicing

All approved producers and importers in the producer register pay for the administration of the system. Fees consist of a one-off registration fee and an annual quantity-based fee. The fee rates are calculated once a year; they are decided by the Ministry of Environment further to a recommendation from the board of DPA. The rates are published every year on our website.

DPA annual fee rates 2024

| Product area | Fee type | DKK/tonne | DKK/tonne (total) | Weight limit for minimum fee (less or equal to) | Minimum fee (DKK) |

|---|---|---|---|---|---|

| Electronics placed on the market (EEE) | General | 20.89 | 20.89 | 11.97 tonnes | 250 |

| EEE-households | + supplement for allocation | +7.54 | 28.43 | 8.79 tonnes | 250 |

| Batteries placed on the market | General | 7.53 | 7.53 | 33.18 tonnes | 250 |

| BAT portable* | + supplement for portable | +28.55 | 36.08 | 6.93 tonnes | 250 |

| Vehicles | Per unit | 1.11 per unit | 1.11 per unit | 226 units | 250 |

Understand your invoice

The annual fee is calculated as a fee rate multiplied with the quantities sold by the producer in the previous calendar year. The quantity of electronics and batteries is stated in kilograms/tonnes, whereas vehicles are stated in units.

The fee consists of a general fee and a supplementary fee for calculation of the allocation of equipment for private use. The fee, therefore, is shown with a general rate for equipment for professional use and a rate applying to equipment for private use and similar. The same applies to batteries where there is a general fee for industrial and automotive batteries and a supplement for the allocation of portable batteries (+ a separate fee paid to SKAT- the Danish Tax and Customs Administration).

If the quantity of products sold by your business in Denmark last year is equal to or less than the shown weight limit, you will pay an annual minimum fee of DKK 250.

Find your invoice

When we invoice you for the one-time-registration fee and the annual quantity fee, we always send the invoice to your digital mailbox at the platforms virk.dk and e-Boks, which you must access to find the payment notification.

Check your annual fee

In our Online Calculator, you can enter the expected or reported annual volumes placed on the market and see what you should expect to pay for the administration of your registration and reporting to the producer register.

NB! The fee rates are calculated annually after each reporting period. Our Online Calculator is exclusively to be seen as a guiding tool made available to producers and importers wishing to know the cost level associated with their registration for producer responsibility. We take reservation for changes that may influence the final result. The use of the calculator must not be mistaken as an expression of our final decision.

Invoicing

Payment rights from DPA

DPA is the authority in Denmark responsible for registrations regarding producers and importers subject to producer responsibility legislation, and we exclusively submit invoices based on current legislation in Denmark. Thus, we are NOT a customer, a supplier, or any other collaborator governed by private law to businesses registered in the producer register. Invoices from DPA to Danish companies, or Authorized Representative (AR) for an EU-based company, will be sent as digital mail via the Danish business registration number (CVR). Only foreign companies outside the EU will receive invoices through the company's contact e-mail.

Further about economics

There may also be costs connected with the marking of products with “the crossed-out wheeled bin” and any commercial agreements you may enter with collective schemes.

Also income

The resources recovered in the collection and recycling of waste electronics will often have a positive value, so occasionally you may get a fine revenue through the sale of end-of-life products to the resources and raw materials industries.

Single-use plastic products

Every quarter of a year registered businesses report the number of filters sold. Reporting is done in pieces, and a fee corresponding per filter placed on the market in the period is paid to cover the cost of cleaning up litter. The reporting itself must be done with MST via virk.dk. Please refer to the fee rate in the latest regulation.

See more about tobacco product filters

See more about invoicing, types of fees, rules on marking and collective compliance schemes below.

Fee types and invoicing

You must pay a registration fee for each product area – one for electronics, one for batteries, etc. The registration fee for the first product area amounts to DKK 1,000, whereas the following product areas trigger a fee of DKK 500 each. A ‘product area’ means electronics, or batteries, or vehicles.

If your business has been deleted from the register due to non-compliance with, e.g., reporting or payment of statutory fee, DPA will levy a new registration fee at the re-registration of your business.

Your registration is linked to the business’s CVR/VAT number. This means that if the CVR number is changed, a new registration fee will be levied.

Once a year you must pay a fee based on the quantity of products you have placed on the Danish market. The fee rate is multiplied with the quantity you have reported during the annual reporting period for the previous calendar year.

The fee consists of a general fee and a supplementary fee for calculation of the allocation of equipment for private use. The fee, therefore, is shown with a rate for equipment for professional use and a rate applying to equipment for private use.

If the result of the calculation of the fee (quantity sold by you multiplied with the rate) is less than DKK 250, we will invoice a minimum fee of DKK 250.

The weight limits for minimum fees are calculated together with the fee rates and are published in the same way.

Example (2024 rate):

The weight limit for minimum fee for electronics for use in private households in 2024 is 11.97 tonnes.

A business has sold a number of refrigerators with a total weight of 7,000 kg – so this figure is reported.

The annual fee will amount to: DKK 250 (minimum fee)

In addition, there is an administrative fee of DKK 729, which is charged on an hourly basis to producers and collective schemes, for extraordinary use of administrative time in DPA.

DPA’s operation is financed through fees paid by producers and importers. Statutory rules for electronics, batteries, and vehicles come in three individual packages, and all three fields must be self-financing. Fees are calculated separately for each of the three fields. It appears from the DPA invoice what product area the fee relates to.

DPA invoices fees with a 14 days’ deadline for payment. The invoice is sent to the digital mailbox of the business for Danish businesses.

Costs relating to payment of invoice

The business will cover any costs relating to foreign currencies or costs associated with financial institutions’ payment transfer. DPA must receive the exact amount that appears from the invoice.

Non-payment

If an invoice is not paid within the above deadline, the following steps are taken, each with a 14 days’ interval:

- Reminder regarding non-payment of invoice

- Notice on deletion of registration

- Registration deleted from producer register

If the payment remains unpaid after the above procedure the case is transferred to the Danish Environmental Protection Agency who is the supervisory authority for producer responsibility in Denmark. Non-payment is seen as non-compliance with the producer responsibility, so subsequently the producer cannot legally sell his products in Denmark.

If the producer wishes to continue placing in-scope products on the Danish market he will have to re-register. This is done by contacting DPA who will re-establish the registration of the business. This will trigger a new registration fee as well as payment of the outstanding payment.

Invoicing of fees to DPA through collective compliance scheme

Some collective schemes offer collective invoicing, which means that the collective scheme carries an expense on behalf of the producer; here, the collective scheme becomes the payment administrator. If the payment is not received in due time and correctly from the payment administrator DPA will direct our claim for payment directly to the producer.

CVR number: DK29028842

EAN: 5790002305924

Bank: Danske Bank, Holmens Kanal 2, DK-1092 Copenhagen K

Account: 4183-3001879154

IBAN: DK7630003001879154

SWIFT: DABADKKK

Time limit for payment: 14 days

So called environmetally graduated fees are obligated with the minimum requirements which entered into force january 2024.

The requirement of graduated fees concerns only collective schemes and their members. DPA has no insight and concern in this matter.

See new legal criteria for graduation of fees and type of product at collective schemes page

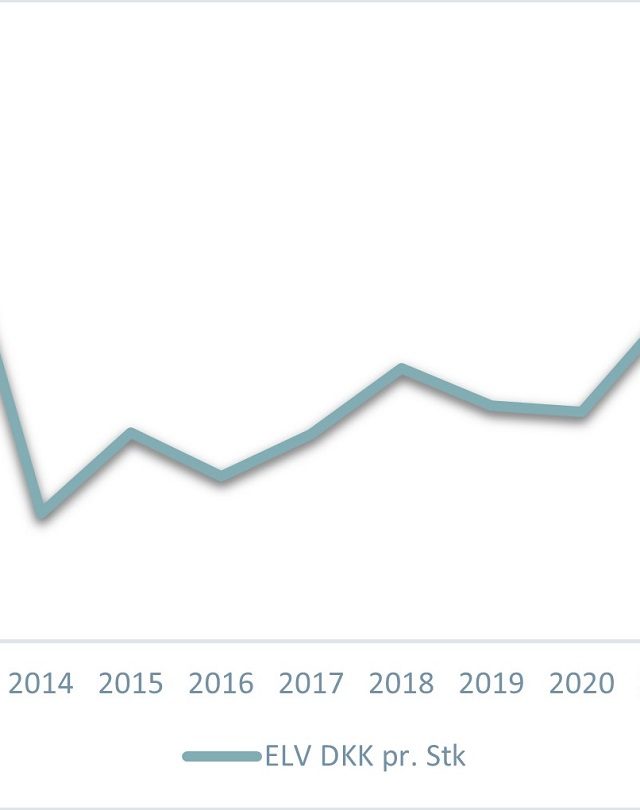

Development in fees

Shortcuts

Costs

Read the document about costs associated with compliance with the producer responsibility system

Financial guarantee and refunds

Read about provision of financial guarantees for products for use in households and about refunding of fees if your products are exported

Cease, changes, mergers

See what to do if there are changes in connection with your business that have an impact on your registration

Deletion

See what to do if your registration is deleted and you want to re-registrate

Guidelines from SKAT regarding portable batteries

Read about how portable batteries are reported to the Danish Tax and Customs Administration (SKAT) - see guidelines E.A.7.10.3)

Duty of payment to SKAT - portable batteries

Read the Danish Environmental Protection Agency’s publication of the fee rates to SKAT - only applies to portable batteries

Online calculator

Test out our online calculator. See what you should expect to pay annually in fees and producer contributions

Marking of equipment

See how to mark your electronics and batteries. Marking is primarily a pictogram with a crossed-out wheeled bin

Terms of payment

Find document with detailed information about information used in our invoicing

Guidelines for Registration and Annual Reporting

Step-by-step document : Guidelines for registration and reporting 2022.

Report

See what all complying businesses must do once a year in the reporting period.

Access to our register

See how to access our register